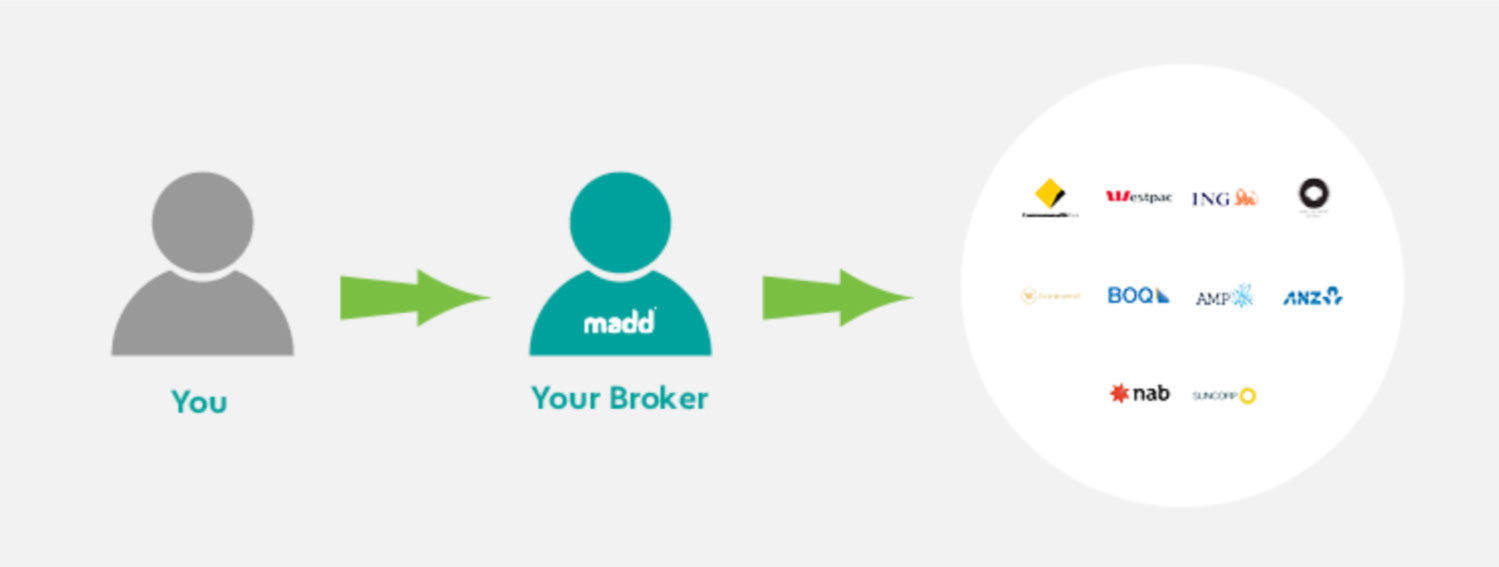

Tailored Solutions For Your Unique Situation:

At Madd, we understand that each financial hardship situation is unique. Our team will take the time to assess your specific circumstances, listen to your concerns, and develop a personalised plan to help you regain financial stability. We’ll review your financial documents, analyse your budget, and provide expert advice based on your individual needs and goals.

Expert Guidance Every Step Of The Way:

Dealing with financial hardship can be overwhelming, but you don’t have to face it alone. We’re here to provide expert guidance and support throughout your journey towards regaining mortgage stability. Our team has extensive experience in navigating challenging financial situations, and we’ll be by your side, offering the knowledge and resources you need to make informed decisions.

Contact Madd For Financial Relief:Building and Pest Inspections:

If you’re facing financial hardship and struggling to meet your mortgage obligations, Madd is here to help. Our compassionate team is dedicated to finding the best solutions for your specific situation, whether it’s through loan modifications, repayment plans, or mortgage forbearance. We believe that everyone deserves the opportunity to regain financial stability and maintain their home. Contact us today to schedule a consultation and take the first step towards overcoming financial hardship.