MORTGAGE GUIDANCE

After The Loss Of A Loved One

GUIDANCE

After A Loss

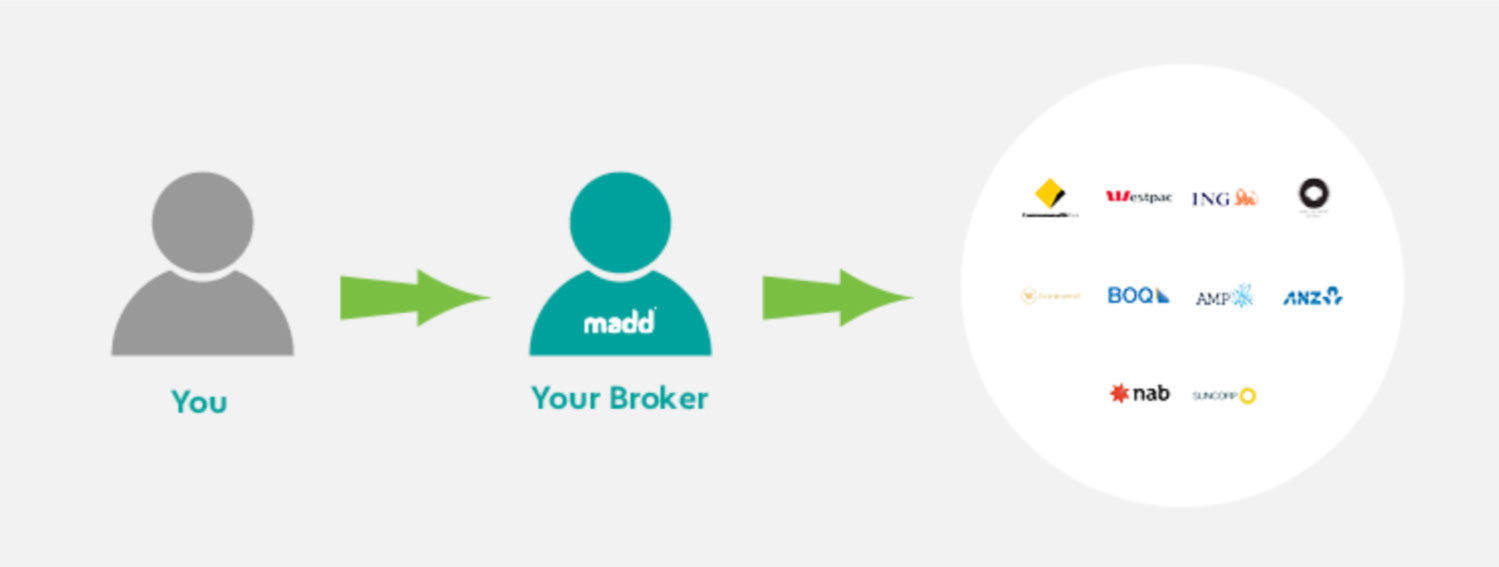

Experiencing the loss of a spouse or co-borrower is emotionally devastating, and it brings unique challenges to your mortgage responsibilities. This guide offers compassionate, expert advice to help you navigate the complexities of mortgage matters during this difficult time. From transferring the mortgage to your name to evaluating insurance options, find the support and guidance you need to maintain home stability while focusing on your emotional well-being.